Irs Schedule E 2025. One of the key proposals is to change the current seven income tax rates, which range from. Tax year 2025 tax rates and brackets.

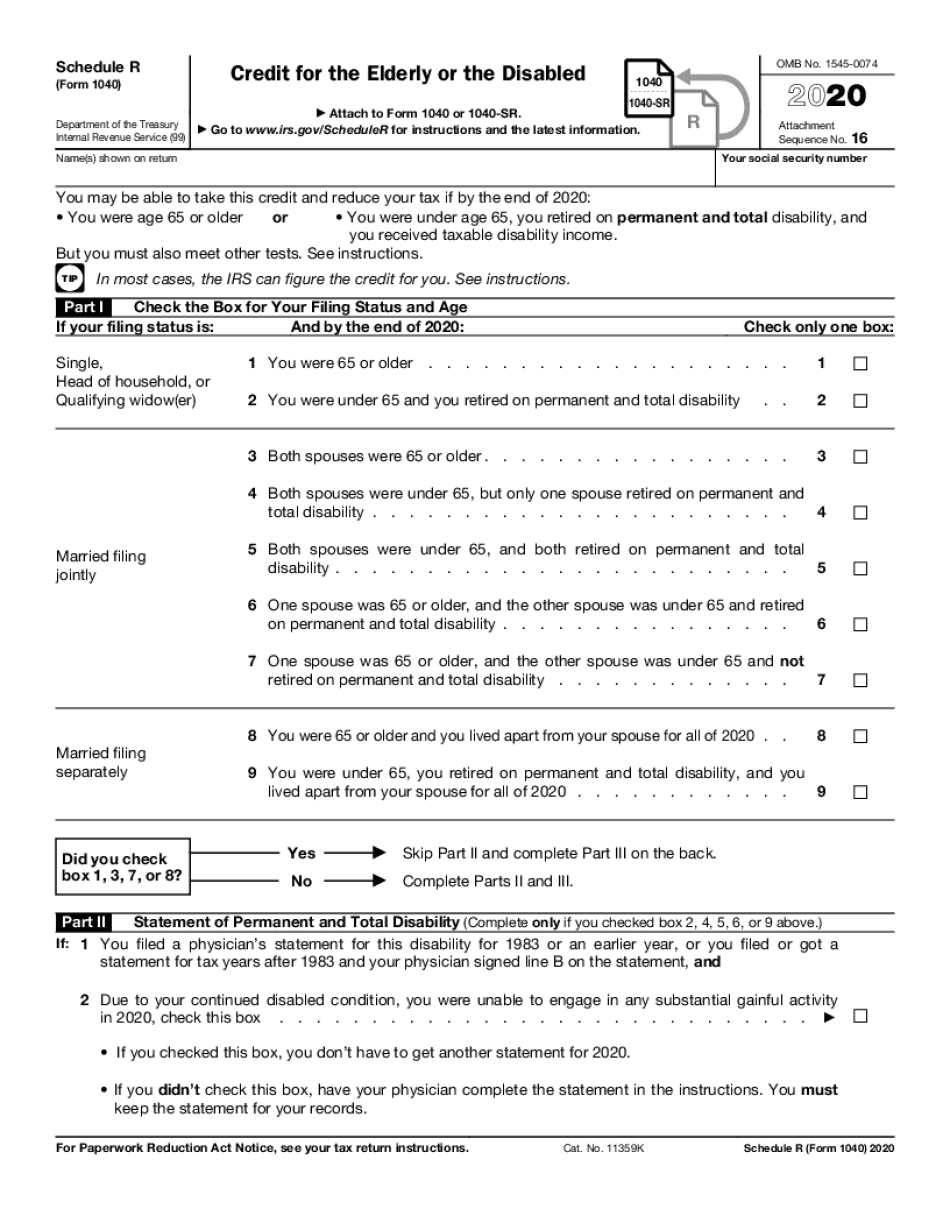

Approved section 3504 agents and cpeos must complete schedule r (form 940), allocation schedule for aggregate form 940 filers, when filing an aggregate form 940,. Regarding taxes, project 2025 proposes several significant changes.

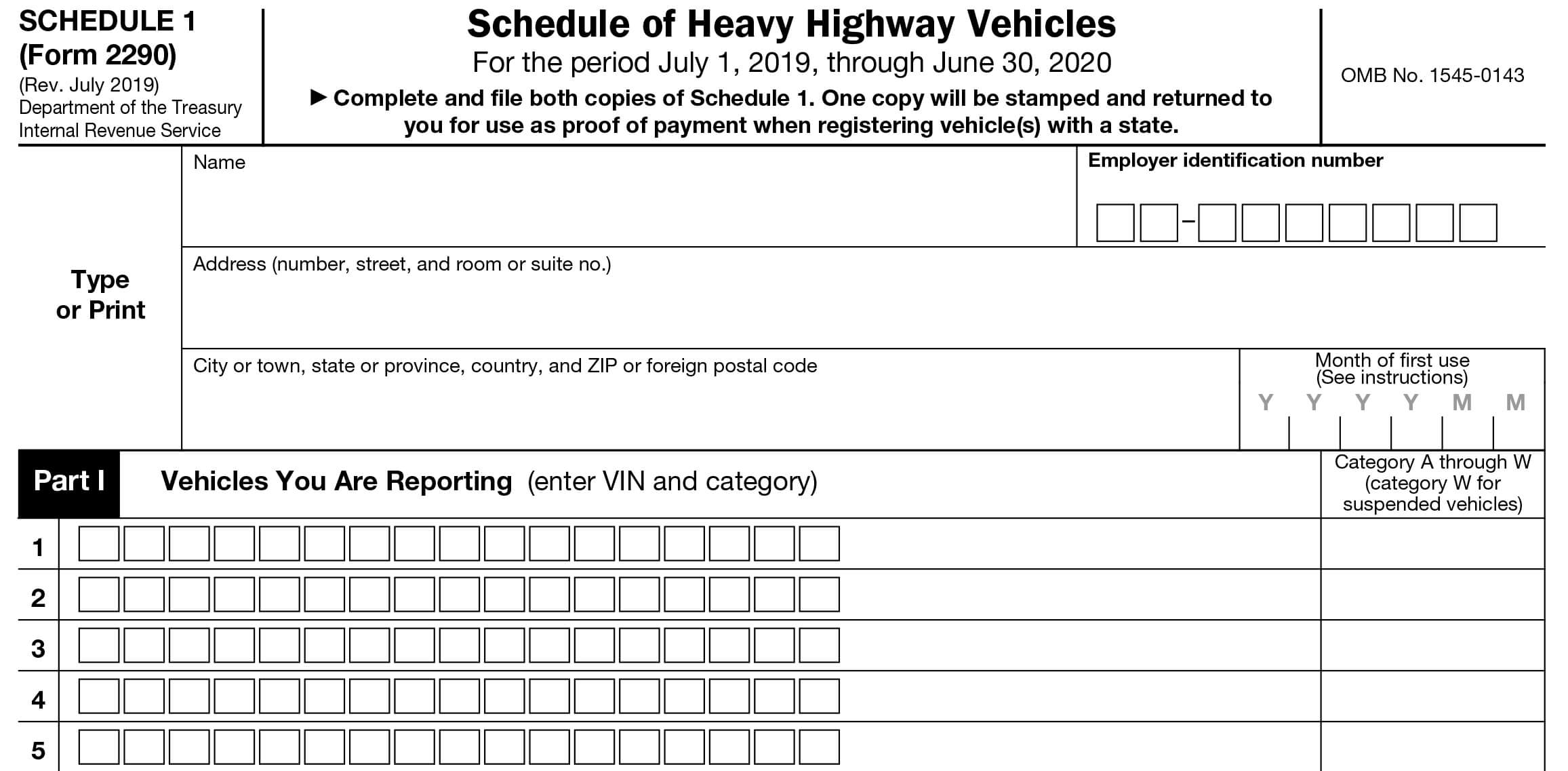

You must file form 2290 and schedule 1 for the tax period beginning on july 1, 2025, and ending on june 30, 2025, if a taxable highway motor vehicle (defined later).

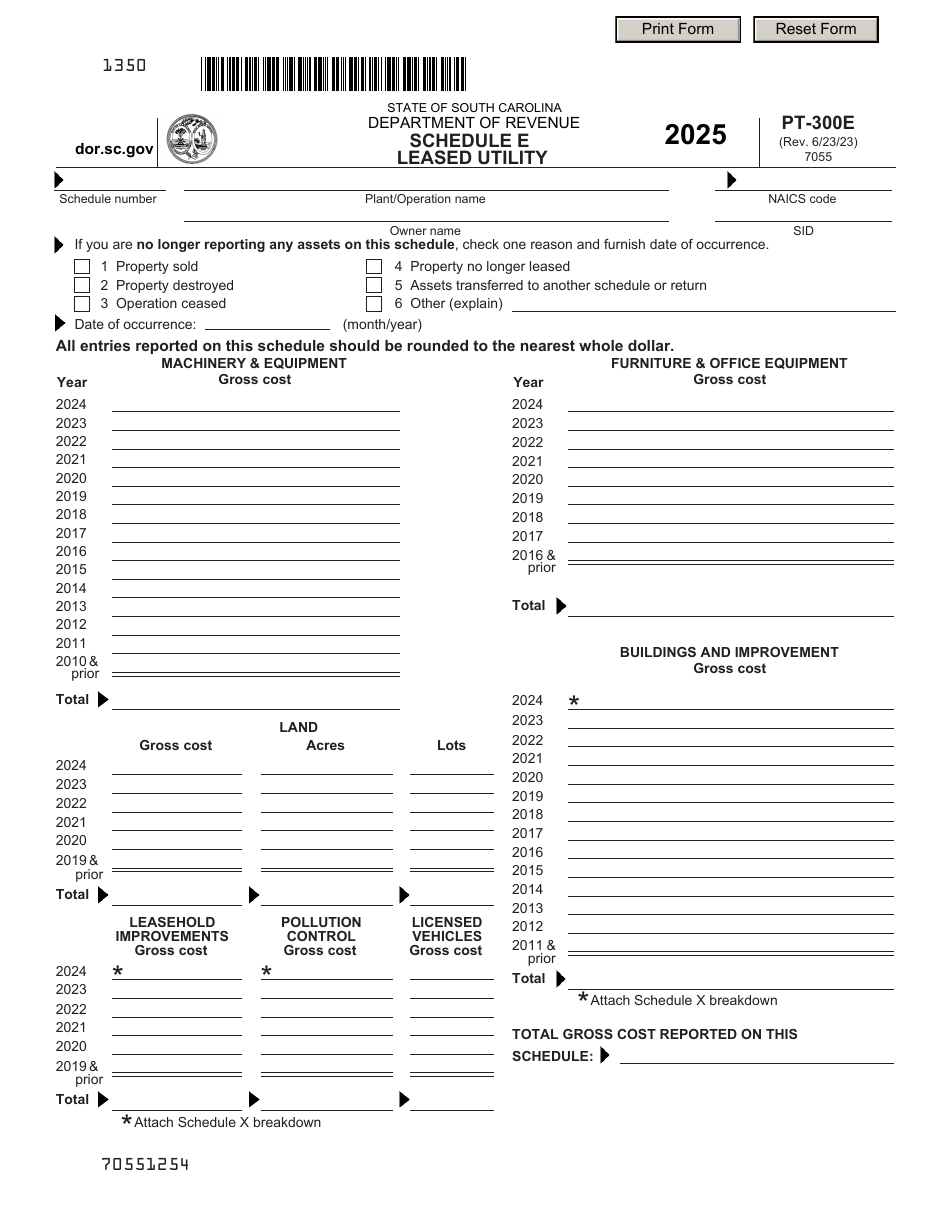

Form PT300E Schedule E 2025 Fill Out, Sign Online and Download, You pay tax as a percentage of your income in layers called tax brackets. One of the key proposals is to change the current seven income tax rates, which range from.

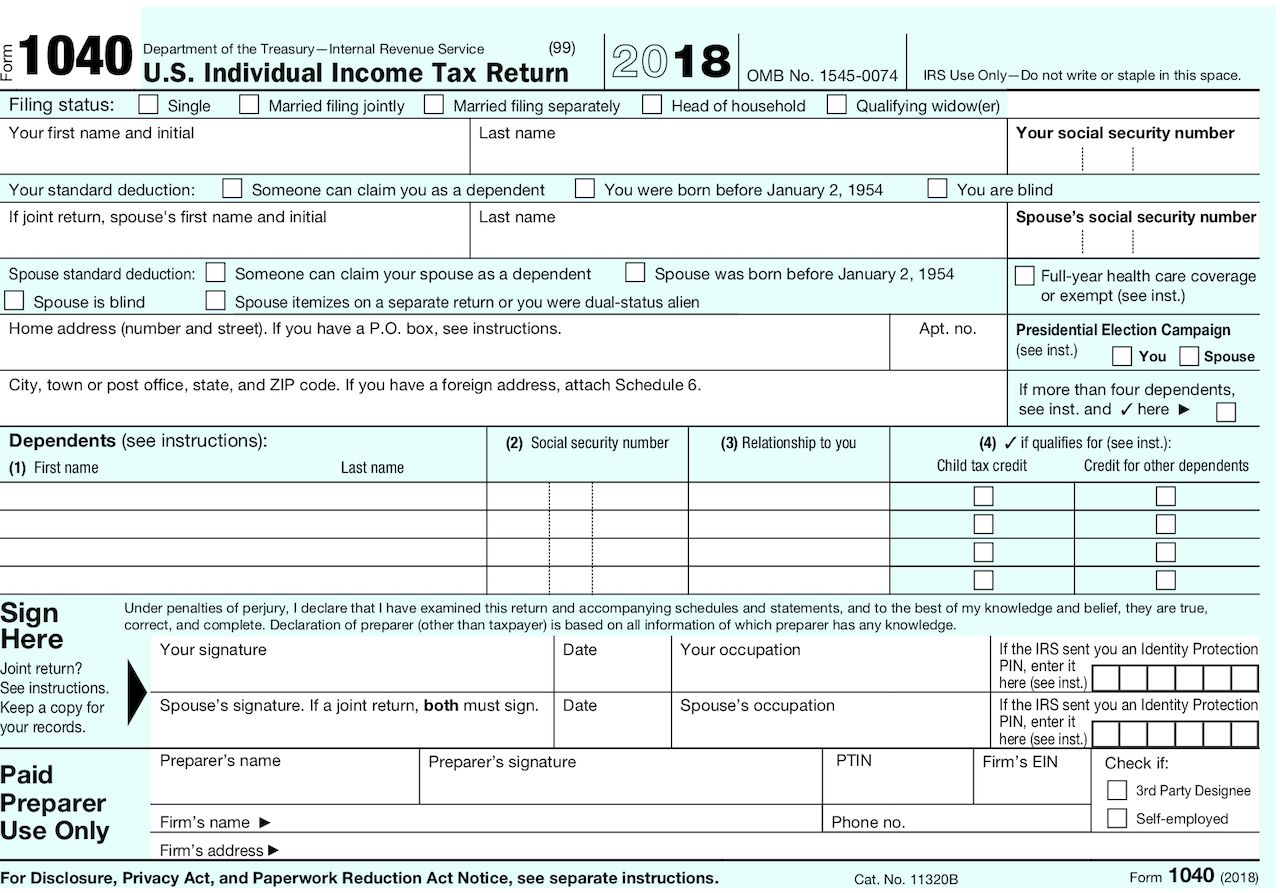

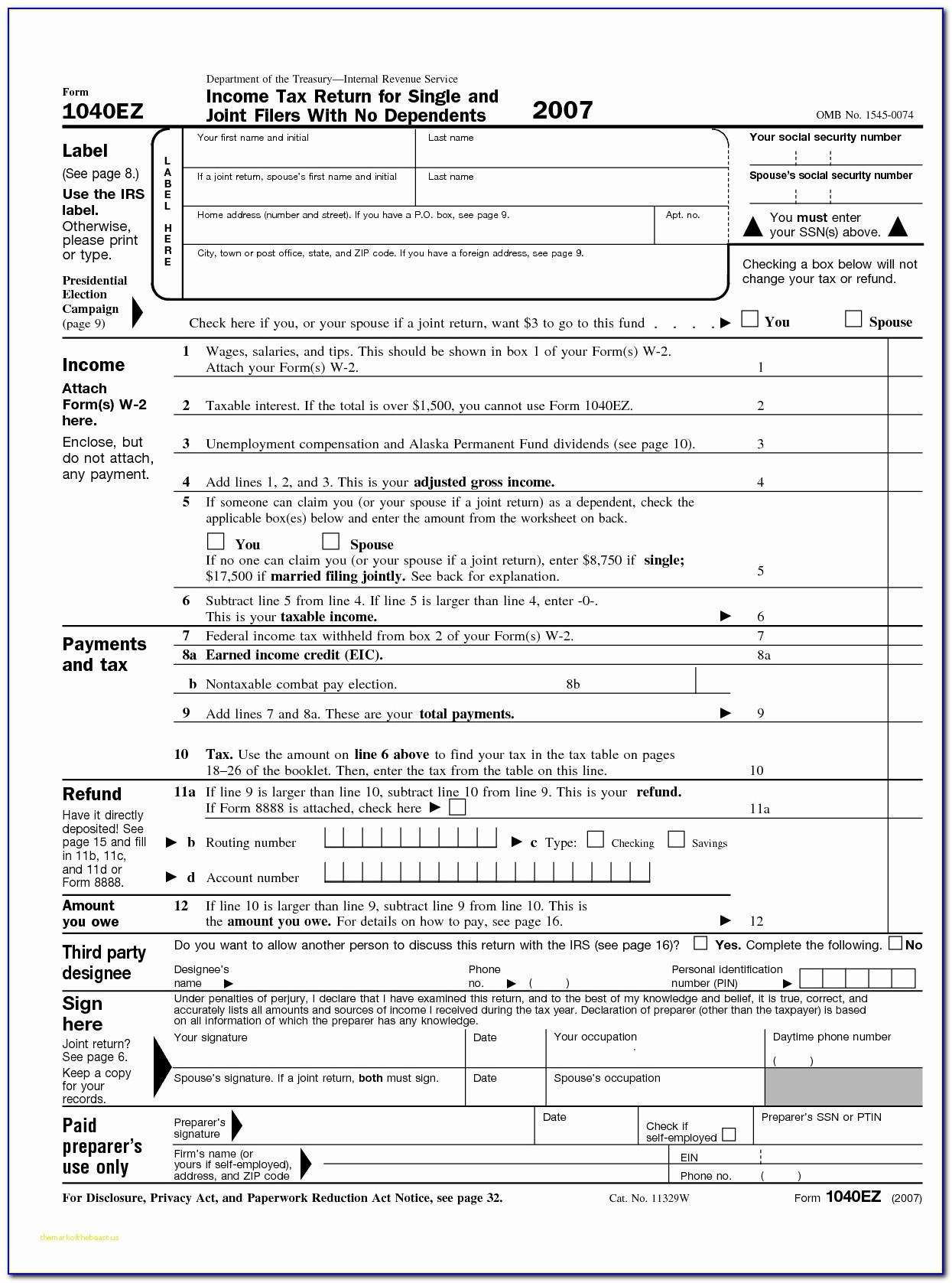

1040 (2023) Internal Revenue Service, The taxstimator will provide you with an estimate based on the information you enter. As your income goes up, the tax rate on the next.

Tax Due Date 2025 Irs Godiva Gennifer, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. Federal income tax rates and brackets.

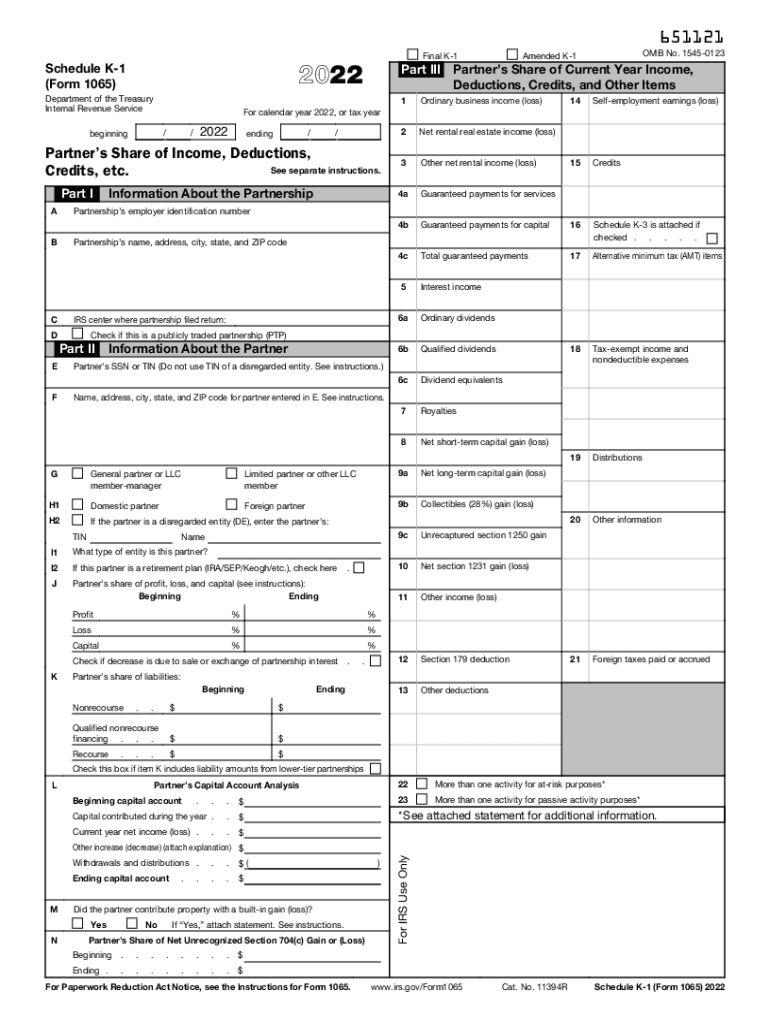

2022 Form IRS 1065 Schedule K1 Fill Online, Printable, Fillable, One of the key proposals is to change the current seven income tax rates, which range from. Most of the changes to the corporate tax code were legislated to be permanent law, but many of the individual income tax provisions, as well as certain other.

Formulario 2290 Anexo 1 EFile del IRS Form 2290 y obtener Schedule 1, In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit. You can attach your own schedule (s) to report income or loss from any of these sources.

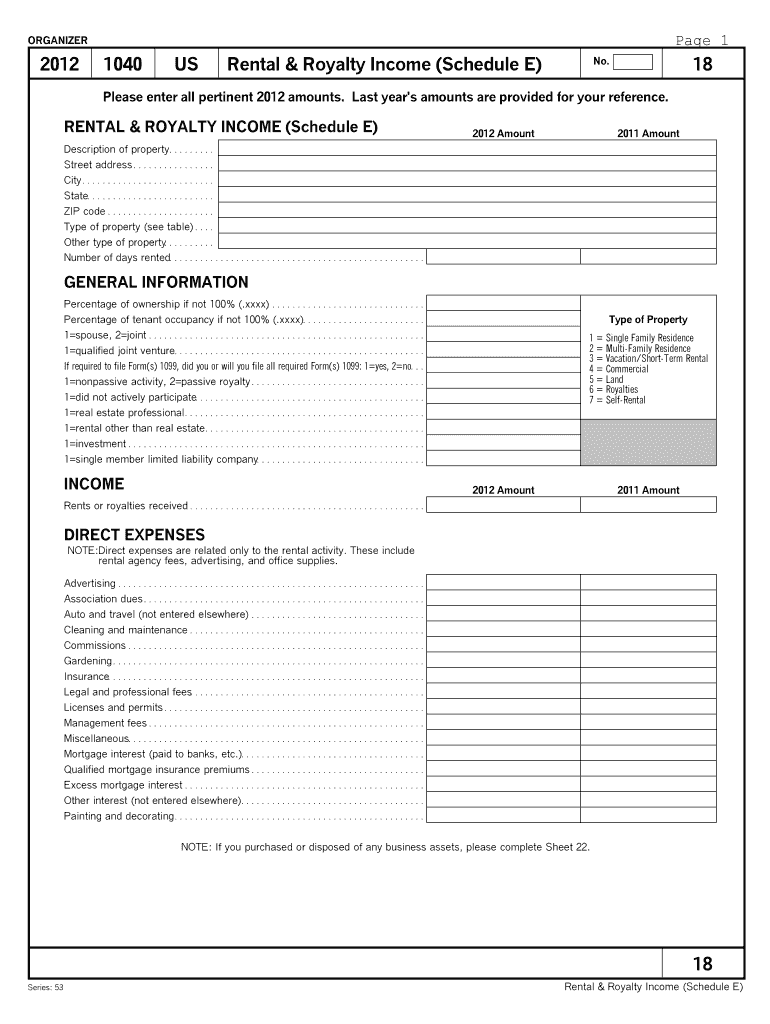

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment, Schedule e is used to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in real estate. Approved section 3504 agents and cpeos must complete schedule r (form 940), allocation schedule for aggregate form 940 filers, when filing an aggregate form 940,.

1040 form instructions tax table, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been. The individual income tax rates of 10%, 12%, 22%, 24%, 32%, 35% and 37% will return to 10%, 15%, 25%, 28%, 33%, 35% and 39.6%, with different.

Printable Irs Form 1040a Printable Forms Free Online, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been. Approved section 3504 agents and cpeos must complete schedule r (form 940), allocation schedule for aggregate form 940 filers, when filing an aggregate form 940,.

Schedule E Worksheet, The annual heavy vehicle use tax form 2290 filing deadline for the tax. Regarding taxes, project 2025 proposes several significant changes.

Irs Tax Extension Form 2025 For Business 2025 Almira Marcelia, Approved section 3504 agents and cpeos must complete schedule r (form 940), allocation schedule for aggregate form 940 filers, when filing an aggregate form 940,. Candidates who are currently studying in the 3rd or higher years of any undergraduate degree program or who have completed any.